Are you tired of shooting around in the dark, unsure of when your prospects are ready to buy? The uncertainty surrounding the timing of potential customers’ purchasing decisions can be a major pain point for trucking dealers and OEMs. But fear not, because RigDig BI by Fusable has the solution to this challenge: identifying buying cycles and a likelihood to purchase.

Identifying Buying Cycles

How does predicting buying cycles work in practice, and why is it essential for your business success? Let’s explore:

Actionable Data for Prospecting: RigDig BI provides you with comprehensive insights into potential customers’ buying behavior, allowing you to tailor your sales and marketing efforts accordingly. By understanding the factors influencing buying decisions, such as equipment age and fleet size, you can prioritize prospects with the highest likelihood of purchasing.

Predicting Buying Cycles: RigDig BI’s advanced analytics enable you to forecast when prospects are due for equipment upgrades or replacements. By analyzing trends in equipment usage and maintenance, you can anticipate when customers will be in the market for new trucks or parts, giving you a competitive edge in targeting and prospecting.

Tailored Marketing Strategies: Armed with insights from RigDig BI, you can develop personalized marketing campaigns tailored to prospects’ specific needs and preferences. Whether it’s offering special promotions or highlighting relevant products and services, precision targeting based on buying cycle preferences ensures that your messaging resonates with potential customers at the right time.

Other Ways to Target the Right Fleets for Replacement or Repair

With an average replacement age of 3-5 years for light to medium duty trucks, identifying buying cycles with data is the key to improving your sales. But there are other strategies you can pair with RigDigBI to make it even more effective. Some of those strategies include:

Customer Surveys and Feedback: You could conduct surveys or interviews with existing customers to gather insights into their purchasing intentions and timelines. Pairing this strategy with RigDig BI’s data allows you to segment and prioritize prospects and customers before you contact them.

Historical Sales Data Analysis: Review the historical sales data of your business to identify patterns and trends in customers’ buying behavior. Then, see how your past sales line up with the buying cycles you identified with RigDig BI. Are you missing out on opportunities?

Customer Relationship Management (CRM) Systems: Sales teams use CRM systems to track customer interactions, inquiries, and service requests. With RigDig BI, you can arm your team with insights on their accounts and help them prioritize who to contact and when.

More Data Sets for Better Insights

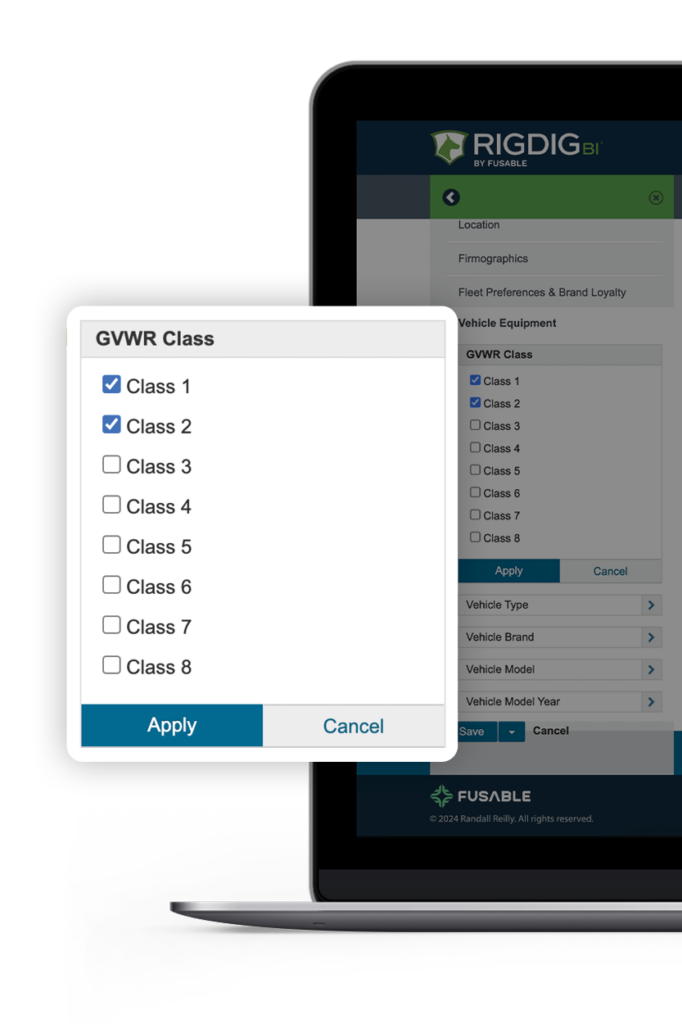

RigDig BI recently announced the expansion of its data sets to now include Class 1-2 trucks, complementing its existing Class 3-8 offerings. This enhancement marks a significant milestone in RigDigBI’s mission to empower dealers and aftermarket businesses with actionable insights for targeted prospecting and enhanced customer engagement. With this latest addition, RigDigBI now offers modeled segments identifying who is likely operating both light duty (Class 1-3) and medium duty (Class 4-6) trucks, providing dealers and aftermarket businesses with a comprehensive view of the market landscape.

And when in doubt, or to avoid lot rot, dealers can offer specific promotions and incentives.

In today’s competitive landscape, predicting when prospects with different buying cycle preferences will be in market is no longer a luxury but a necessity for trucking dealers and OEMs looking to stay ahead of the curve. With RigDig BI’s innovative solutions, you can eliminate the guesswork and uncertainty surrounding prospecting and sales, allowing you to focus your resources more effectively and drive growth for your bottom line. Get started today and ensure that you never miss your window of opportunity again.